Download Hike Messenger App for Free

Download HIKE

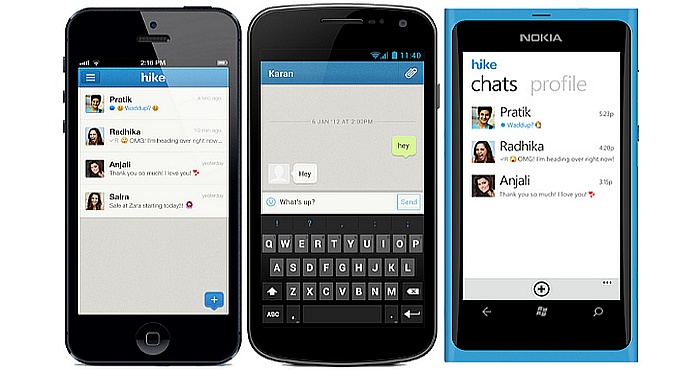

HIKE App for smartphone and tablet

Download Hike Messenger for iPhone, Android, Blackberry, Windows Phone and Nokia S60 series. This Amazing app will allow you to share images, text, messages, voices and videos even without 3G-4G connection. Yes! Hike can send SMS instead and you will always be connected wih your friends and family. Get it today for free for your device!